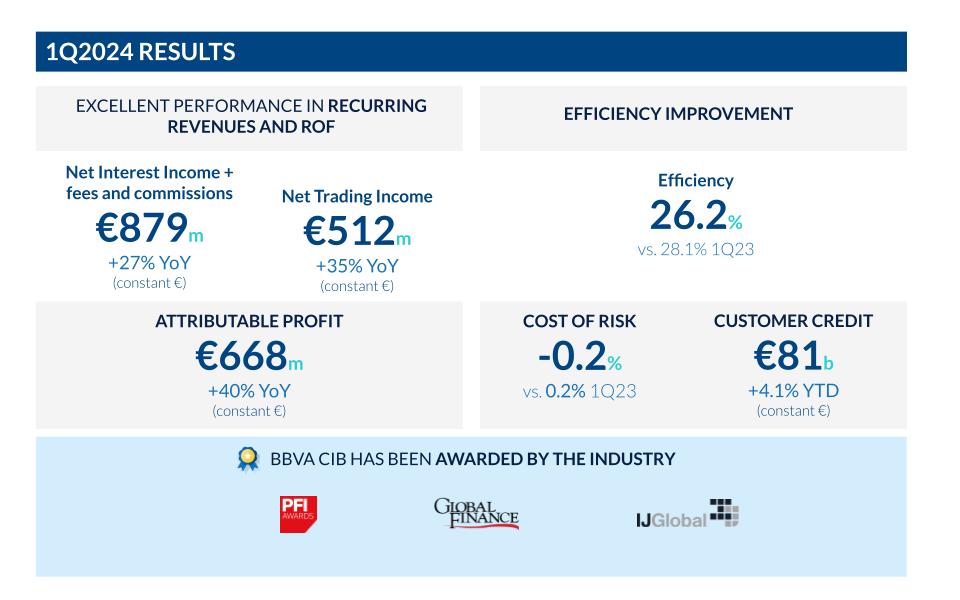

- BBVA CIB achieves an accumulated net attributable profit of 668 million euros in the year, a year-on-year growth of +40% (in constant euros and does not reflect the application of hyperinflation accounting).

- Good evolution of the activity and the growth of revenues are of particular note, reaching 1,369 million euros, up by 31% in 2023.

- Double-digit growth of all business units: Global Markets +24% YoY, backed by intense commercial activity, particularly good performance in FX, Equity and Credit; GTB +36% YoY, thanks to the positive growth in both net interest income and fees; and IB&F +31% YoY, with excellent activity in Project Finance in the Americas and Europe.

- Improvement in the efficiency ratio, which stands at 26.2%, and increase in the profitability of the businesses.

In the first quarter of 2024, BBVA Corporate & Investment Banking generated revenues of 1,369 million euros, up by 31% on 2023. The company’s investment banking division stood out for achieving a net attributable profit of 668 million euros, +40% YoY.

As at the end of 2023, BBVA CIB maintained 16% of the Group’s gross income, to which all business units contribute. The entity’s strategy is based on its global reach, with a focus on geographical diversification, nearshoring opportunities and increasing the relevance of the business with institutional clients, and sustainability, through its investment in clean technologies and renewable energy projects.

Business units performance

Global Markets closed the first quarter of 2024 with a great result, supported by intense marketing activity sustaining 24% growth in all products. The FX business performed strongly as a result of robust positioning in emerging markets (Mexico, Turkey and South America) where BBVA is a leading provider. The equity business went back to strong growth supported by the development of its product platform, and Credit has great momentum backed by both primary and secondary markets.

The Global Transaction Banking business started the first quarter of 2024 with revenues of 572 million euros, in line with the last quarter of 2023. This solid performance is mainly due to the delay in lowering interest rates – which enables the continued support of revenue production – and commendable price management. These factors have allowed the net interest income to consolidate for another quarter, and enabled the contribution of fee and commission income to the earnings in this period, on the strength of good transactional activity with the main clients and record levels of activity across all sectors. Fees and commissions returned to double-digit growth in the quarter and generated consistency in revenues.

The Investment Banking & Finance activity showed excellent performance in the first quarter of the year, with revenues of 277 million euros (+31% YoY), mainly in Spain and the rest of Europe. We should note the Project Finance activity in the Americas and Europe, where BBVA ranks first in Mexico, Colombia, and Peru, and sixth in the rest of Europe, excluding Spain, based on volume. All this has been possible despite the fact that the global level contraction in demand for syndicated loans continues, reaching one of the lowest levels in recent years.

M&A activity continues to be affected by macroeconomic and geopolitical uncertainties and volatility. Nevertheless, we observe a slight increase in most geographies. Also, Equity Capital Markets are showing incipient levels of recovery in most of the regions, while still waiting to see whether or not they will consolidate over the course of the year.

A geographically diversified business

The cross-border business consolidated its contribution to CIB. Leveraged on its positioning and product capabilities in different geographies, it maintains the growth path already seen throughout 2023, in which it reached +30%. In this first quarter of 2024, there was greater business acquisition in Europe, channeling investments in South America and Mexico.

The United States ranks as the second-largest exporter of CIB business to other CIB geographies, underscoring the importance and quality of the U.S. client base. In this geography, BBVA’s focus continues to be on capturing sustainable opportunities in the U.S. market and expanding the corporate and institutional client base. In addition, BBVA’s teams in Asia and other regions strive to support the global expansion of Asian multinationals, with a particular focus on companies leading the development of technologies with a positive impact on decarbonization, such as Envision and Geely.

The value proposition of BBVA CIB, globality and sustainability, allows the bank to assist its global clients in their important investments in energy transition.

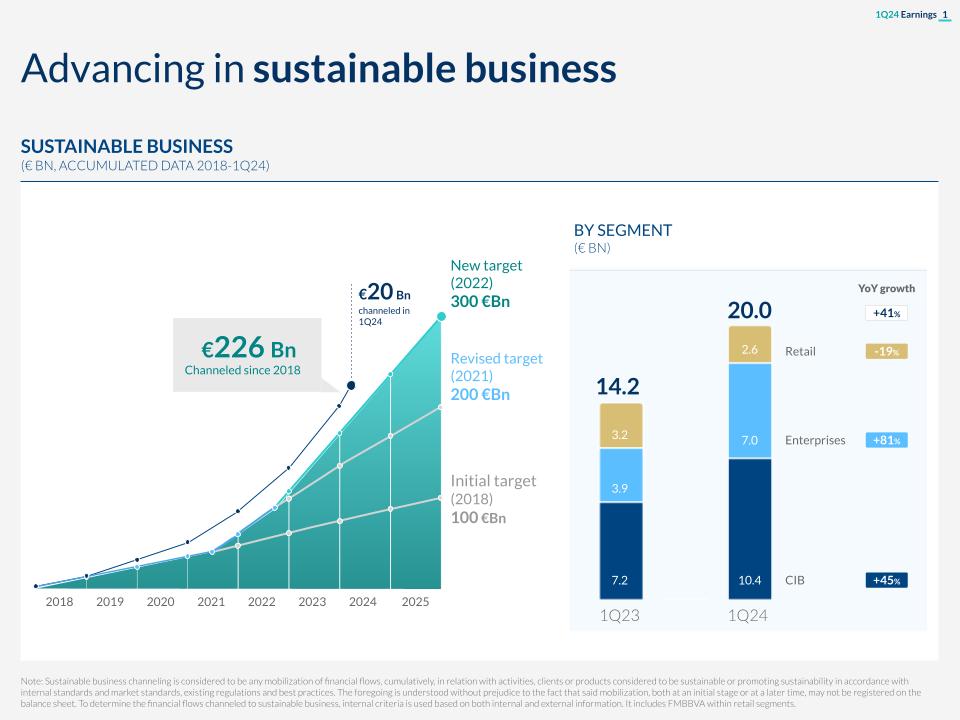

Sustainability as a driver of business

BBVA CIB channeled around 10,400 million euros during Q1 2024, specifically with positive performance of all products, both long-term and short-term finance and bonds intermediation in which the company acts as a bookrunner. During this quarter, BBVA has continued to promote clean technology funding, renewable energy project finance and sustainability-related accounts payable financing, among other strategic lines, in the wholesale segment. In terms of pipeline, we should note the project finance of renewable energies, which has contributed more than 800 million euros during this quarter, up by 780% YoY.

Industry recognition for BBVA CIB

BBVA was recognised by Global Finance as the best investment bank in Spain, Mexico and Peru. For the ninth consecutive year, the bank has been considered the best investment bank in Spain, as well as the best investment bank in Mexico for the eighth time. In addition, this is the first time that BBVA Peru has been recognized in this category. These three awards support BBVA’s commitment to investment banking, underscoring its leadership in offering innovative and effective solutions in each of these geographies.

In terms of sustainability, Global Finance awarded BBVA the distinction of best bank for green bonds in Latin America and best bank for sustainable finance in Spain 2024.

Other industry accolades include various ‘deals of the year’ awarded by the trade media outlets PFI and IJ Global in the field of project finance.